INFORMATION VS. UNDERSTANDING

In this piece, we note the subtle differences between data, information, understanding and knowledge. With the plethora of data and information available, the investment community cannot miss a beat on the analysis work to critically understand valuable data/information. Yet, time spent by analysts on data collection, preparation, error correction, and information aggregation takes valuable resources away from rapid synthesis of knowledge. Efficient use of gathering/maintaining data and information and understanding through your IRO (Investment Research Outsourcing) partners like ValAn can help you in getting to the knowledge/wisdom phase quicker which often leads to successful (investment) decision making.

Our insights here are not obviously new, but are rather borrowed from Dr. Russell Ackoff, an expert in organizational change. The website http://www.systems-thinking.org/dikw/dikw.htm is a good resource for the definitions of data, information, understanding and knowledge. Directly from this source:

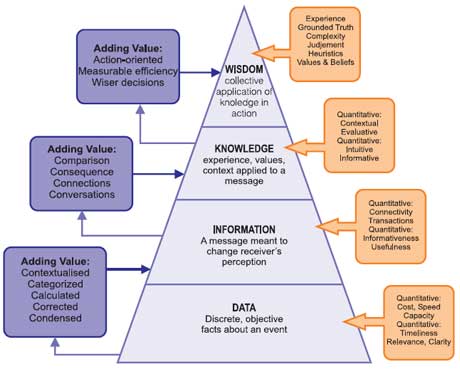

“According to Russell Ackoff, a systems theorist and professor of organizational change, the content of the human mind can be classified into five categories:

- Data: symbols

- Information: data that are processed to be useful; provides answers to “who”, “what”, “where”, and “when” questions

- Knowledge: application of data and information; answers “how” questions

- Understanding: appreciation of “why”

- Wisdom: evaluated understanding”

The picture below from http://www.trainmor-knowmore.eu/ can also help us to draw out the subtleties of these five commonly used words.

How does this then apply to the Investment Research Outsourcing (IRO) domain?

IRO firms like ValAn can help you get faster to the “understanding” and “wisdom” phases of the investment process, at a fraction of the additional resources needed. A quick (yet accurate) updates of historical earnings models or comp sheets is a trivial example often used to quote the benefit of IRO to investment firms.

Yet, more importantly, the subtle feedback mechanism (which we talk about in prior posts) while updating such earnings models/sheets, when the IRO employee encounters a “difference” or a “question” to the client can be critical to raising “red flags” in a fast paced environment. Taking this a step further, an experienced IRO supervisor can take the issue to beyond a simple “client question”, because he or she appreciates the “why” or “understands” as to how it can help the investment client. It is to these levels of “knowledge” and “understanding” that we aspire our employees to be.